WorldCare

Our award-winning flagship WorldCare product is designed to be comprehensive and benefit rich, with different levels of cover to suit various lifestyles. Providing easy access to world-class health facilities worldwide, WorldCare provides our globally mobile members with peace of mind that they can access the best care both at home and overseas.

There are four levels of cover to choose from, ranging from essential hospital care through to our most comprehensive plan which includes in and out-patient treatment cover, including dental and maternity. All our plans come with the great service Now Health International is renowned for, including our fast and accurate claims service and state of the art digital tools.

*WorldCare Essential not available in Abu Dhabi

WorldCare Advance

WorldCare Advance covers you for in-patient, day-patient and out-patient treatment including GP and specialist appointments, physiotherapy and alternative therapies.

A restricted network additional option is available to residents of the UAE, which offers a discount in return for limited access to any treatment in the American Hospital and associated clinics, City Hospital, Welcare Hospital and associated clinics of the Mediclinic Group.

WorldCare Advance is suitable for people who want all-round medical care.

For those people who are resident or working in the Emirate of Dubai, the following benefits are automatically included:

Dubai Health Authority (DHA) Mandatory requirements Benefit – Tier 2

For Insured Persons holding a valid visa for the Emirate of Dubai this Plan is extended to provide coverage up to USD 41,000 in aggregate per Insured Person, per Period of Cover for the following basic health services within the Emirate of Dubai and for Emergency services within the United Arab Emirates:

i) Pre-existing Conditions including Maintenance of Chronic Medical Conditions.

ii) Medically Necessary costs incurred during normal Pregnancy and childbirth, including pre and post-natal check-ups subject to Pre-authorisation

- A cover is provided for eight visits to a Primary Healthcare (PHC) obstetrician for low-risk patients and a specialist obstetrician for high-risk patients.

- Visits to include reviews and checks and tests in accordance with the DHA antenatal Protocols. Initial investigations to include FBC and platelets, blood group, rhesus status and antibodies, VDRL, MSU, urinalysis, rubella serology, HIV, FBS, randoms or A1C and for high-risk patients GTT and Hepatitis C.

- In-Patient maternity is limited to a maximum of USD 1,950 for normal pregnancy and USD 2,750 for C-section per Insured Person, per Period of Cover.

- The cost of three antenatal ultrasound scans.

iii) The costs of accommodation of an accompanying person as an In-Patient in the same room in cases that are Medically Necessary at the recommendation of the Medical Practitioner or Specialist. Subject to Pre-Authorisation and up to a maximum of USD 28 per night.

iv) Essential Vaccinations and inoculations for newborns and children as stipulated in the DHA policies and its updates, in assigned facilities.

v) Preventive screening for diabetes and other screening as stipulated by the DHA every three years for Insured Persons above the age of 30 and every year for 18 years and above for Insured Persons considered high risk.

Unless otherwise indicated these Benefits will not be payable for Treatment outside the United Arab Emirates.

For maternity Benefit outside of the United Arab Emirates, the optional maternity Benefit must be selected or the Apex Plan chosen.

WorldCare Excel

WorldCare Excel covers you for in-patient, out-patient and day-patient treatment at higher benefit levels than WorldCare Advance.

It also includes routine and complex dental care after a nine-month wait period.

A restricted network additional option is available to residents of the UAE, which offers a discount in return for limited access to any treatment in the American Hospital and associated clinics, City Hospital, Welcare Hospital and associated clinics of the Mediclinic Group.

For those people who are resident or working in the Emirate of Dubai, the following benefits are automatically included:

Dubai Health Authority (DHA) Mandatory requirements Benefit – Tier 2

For Insured Persons holding a valid visa for the Emirate of Dubai this Plan is extended to provide coverage up to USD 41,000 in aggregate per Insured Person, per Period of Cover for the following basic health services within the Emirate of Dubai and for Emergency services within the United Arab Emirates:

i) Pre-existing Conditions including Maintenance of Chronic Medical Conditions.

ii) Medically Necessary costs incurred during normal Pregnancy and childbirth, including pre and post-natal check-ups subject to Pre-authorisation

- A cover is provided for eight visits to a Primary Healthcare (PHC) obstetrician for low-risk patients and a specialist obstetrician for high-risk patients.

- Visits to include reviews and checks and tests in accordance with the DHA antenatal Protocols. Initial investigations to include FBC and platelets, blood group, rhesus status and antibodies, VDRL, MSU, urinalysis, rubella serology, HIV, FBS, randoms or A1C and for high-risk patients GTT and Hepatitis C.

- In-Patient maternity is limited to a maximum of USD 1,950 for normal pregnancy and USD 2,750 for C-section per Insured Person, per Period of Cover.

- The cost of three antenatal ultrasound scans.

iii) The costs of accommodation of an accompanying person as an In-Patient in the same room in cases that are Medically Necessary at the recommendation of the Medical Practitioner or Specialist. Subject to Pre-Authorisation and up to a maximum of USD 28 per night.

iv) Essential Vaccinations and inoculations for newborns and children as stipulated in the DHA policies and its updates, in assigned facilities.

v) Preventive screening for diabetes and other screening as stipulated by the DHA every three years for Insured Persons above the age of 30 and every year for 18 years and above for Insured Persons considered high risk.

Unless otherwise indicated these Benefits will not be payable for Treatment outside the United Arab Emirates.

For maternity Benefit outside of the United Arab Emirates, the optional maternity Benefit must be selected or the Apex Plan chosen.

WorldCare Apex

WorldCare Apex is our most comprehensive plan with very high benefit limits. It includes in-patient, day-patient and out-patient treatment, at higher levels than WorldCare Excel, as well as routine maternity care after a 12-month waiting period.

It is suitable for those people who want the highest level of cover and perhaps starting to plan a family.

A restricted network additional option is available to residents of the UAE, which offers a discount in return for limited access to any treatment in the American Hospital and associated clinics, City Hospital, Welcare Hospital and associated clinics of the Mediclinic Group.

For those people who are resident or working in the Emirate of Dubai, the following benefits are automatically included:

Dubai Health Authority (DHA) Mandatory requirements Benefit – Tier 1

For Insured Persons holding a valid visa for the Emirate of Dubai this Plan is extended to provide coverage up to USD 41,000 in aggregate per Insured Person, per Period of Cover for the following basic health services within the Emirate of Dubai and for Emergency services within the United Arab Emirates:

i) Pre-existing Conditions including Maintenance of Chronic Medical Conditions.

ii) The costs of accommodation of an accompanying person as an In-Patient in the same room in cases that are Medically Necessary at the recommendation of the Medical Practitioner or Specialist. Subject to Pre-Authorisation and up to a maximum of USD 28 per night.

iii) Essential Vaccinations and inoculations for newborns and children as stipulated in the DHA policies and its updates, in assigned facilities.

iv) Preventive screening for diabetes and other screening as stipulated by the DHA every three years for Insured Persons above the age of 30 and every year for 18 years and above for Insured Persons considered high risk.

Unless otherwise indicated these Benefits will not be payable for Treatment outside the United Arab Emirates.

WorldCare at a glance

Annual Max Plan Limit USD 3.5M

- In-patient and day-patient care

- Out-patient care

- DHA Mandatory Benefit Tier 2

- Routine maternity care

- Routine and complex dental treatment

- Annual deductible

- Out-patient per visit excess (USD 15, USD 25)

- Co-insurance out-patient treatment (10%/20%)

- USA elective treatment

- Extended evacuation and repatriation

- Wellness, optical and vaccinations

- Wellness, optical and vaccinations – Option 2

Annual Max Plan Limit USD 4M

- In-patient and day-patient care

- Out-patient care

- Routine and complex dental treatment

- DHA Mandatory Benefit Tier 2

- Routine maternity care

- Annual deductible

- Out-patient per visit excess (USD 15, USD 25)

- Co-insurance out-patient treatment (10%/20%)

- USA elective treatment

- Extended evacuation and repatriation

- Wellness, optical and vaccinations

- Wellness, optical and vaccinations – Option 2

Annual Max Plan Limit USD 4.5M

- In-patient and day-patient care

- Out-patient care

- Routine and complex dental treatment

- Routine maternity care

- DHA Mandatory Benefit Tier 1

- Annual deductible

- Out-patient per visit excess (USD 15, USD 25)

- Co-insurance out-patient treatment (10%/20%)

- USA elective treatment

- Extended evacuation and repatriation

- Wellness, optical and vaccinations

- Wellness, optical and vaccinations – Option 2

Support to stay well and support when you need it

At Now Health we think it’s important to support you with your overall health and wellbeing. That’s why we offer a range of added value services in addition to your core plan protection, so you know we’re there for you, every step of the way.

Second Medical Opinion

WHY:

A second medical opinion can help provide reassurance, particularly for those who are uncertain about their diagnosis, have a complex condition, or are unsure about what treatment plan to choose.

WHAT:

Leveraging our extensive network of medical experts worldwide, we provide our members with a second medical opinion service to help ensure you get the right diagnosis and the right treatment.

Members can access this service for both acute and long term conditions, and in most cases the second medical opinion will be delivered within a matter of days.

HOW:

Simply contact your local Customer Service team to use this service.

Global Concierge Service

WHY:

As an international health insurance provider, we recognise that many of our members may choose to seek treatment overseas, away from their home country.

WHAT:

To help make this process easier for you, we provide concierge support to help you manage the process. This includes:

- Recommending where to get treatment

- Support to book medical appointments

- Appointment reminders

- Placing guarantees of payment with the hospital, including in an emergency, so you don’t need to pay upfront

- Support with arranging medical visas as and when required

HOW:

Simply contact your local Customer Service team to use this service.

Our Digital Tools

Manage your plan online

The Now Health International website is designed to make it simpler to manage your international health insurance from accessing your plan documents to tracking your claims.

Members can access their information at any time with Now Health, as all your details are stored in your secure online portfolio, which you can access 24-hours a day from anywhere in the world.

You can view and download all your plan documents including your certificate of insurance, members’ handbook and any form you might need to manage your plan.

Submit and track your claims online

You can submit and track the status of all claims you make online. As soon as we receive your claim, we will notify you by email and SMS (if you have chosen this option).

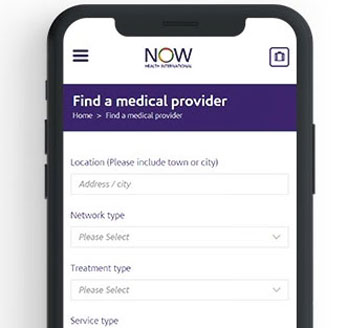

Our Smartphone App

Our smartphone App let’s you claim and find doctors at the touch of a button. You can access thousands of medical professionals worldwide and enjoy quick and easy claims handling.